Crafting Your "Synn's House": A Blueprint For Financial Harmony

More than just bricks and mortar, the concept of "Synn's House" represents a sanctuary of financial stability, a haven where sound economic decisions foster peace of mind and long-term prosperity. It's not merely about owning a dwelling, but about cultivating a living space that reflects prudent management, strategic planning, and a deep understanding of the financial landscape. In an era where economic uncertainties are ever-present, building your own "Synn's House" becomes an essential endeavor, empowering you to navigate challenges and seize opportunities.

This article delves into the core principles of establishing such a financially resilient household. We will explore how understanding personal finance, leveraging tools like personal loans wisely, and adopting smart consumer habits can collectively contribute to the robust foundation and sustained well-being of your metaphorical "Synn's House." Join us as we uncover the pillars of financial harmony and practical steps to secure your domestic economic future.

Table of Contents

- The Foundation of "Synn's House": Understanding Personal Finance

- Navigating Personal Loans: Your Gateway to Growth

- Decoding Loan Costs: Beyond the Interest Rate

- Building the Walls: Strategic Financial Planning for Your Home

- The Roof Over Your Head: Securing Your Financial Future

- Furnishing "Synn's House": Smart Consumerism and Resource Management

- Sourcing Essentials: Lessons from Labaš

- Maintaining "Synn's House": Continuous Financial Health Checks

- The Future of "Synn's House": Adapting and Thriving

The Foundation of "Synn's House": Understanding Personal Finance

Every strong structure begins with a solid foundation, and for your "Synn's House," this foundation is a comprehensive understanding of personal finance. This isn't about becoming a financial expert overnight, but rather grasping the fundamental concepts that govern your money: income, expenses, savings, investments, and debt. Knowing where your money comes from, where it goes, and how it can grow or be managed is the first critical step towards financial autonomy within your home.

In this context, personal loans often emerge as a significant tool. While sometimes viewed with apprehension, a personal loan, when used judiciously, can be a powerful instrument for achieving various financial goals that directly contribute to the stability and enhancement of your "Synn's House." Whether it's consolidating high-interest debt, funding essential home improvements, or covering unexpected but necessary expenses, understanding how these financial products work is paramount.

Navigating Personal Loans: Your Gateway to Growth

Personal loans offer a flexible way to borrow a set amount of money and repay it over a predetermined period, typically with fixed monthly payments and a fixed interest rate. This predictability is a key advantage for budgeting and long-term planning within your "Synn's House." Loan amounts can vary significantly, generally ranging from $3,000 to $100,000, with some lenders even offering up to $200,000, depending on the borrower's creditworthiness and the lender's policies. Importantly, some of the most attractive options come with no origination fee or prepayment penalty, allowing for greater financial flexibility.

The interest rates for personal loans are a critical factor, and they currently range broadly from around 7% to 36% APR. These rates are highly dependent on several factors: the specific lender, the borrower's creditworthiness, the loan amount, the purpose of the loan, and the repayment term. For instance, as of March 3, 2025, fixed annual percentage rates (APR) for personal loans typically ranged from 7.99% APR to 24.99% APR. However, it's worth noting that fixed rates from some providers can go as low as 6.74% APR, with the absolute lowest rates, as low as 6.49%, often requiring specific conditions like autopay and the payoff of a portion of existing debt. These preferential rates are generally reserved for borrowers with an excellent credit history, underscoring the importance of maintaining a strong credit profile for the health of your "Synn's House."

Decoding Loan Costs: Beyond the Interest Rate

While interest rates are undoubtedly a major component of a personal loan's cost, they are not the only costs to consider. Many personal loans, though not all, come with an origination fee. This fee, which can range from 1.85% to 9.99% of the loan amount, is typically deducted from the loan proceeds before the funds are disbursed to you. This means if you're approved for a $10,000 loan with a 5% origination fee, you would actually receive $9,500. Understanding this upfront deduction is vital for accurate budgeting and ensuring you receive the full amount you need for your "Synn's House" projects.

Beyond fees, it's important to remember that other eligibility requirements may apply. Lenders will assess your debt-to-income ratio, employment history, and other financial indicators to determine your capacity to repay the loan. All loan approvals are subject to normal underwriting guidelines, meaning a thorough review of your financial standing. The "as low as" rates often listed are indicative of the best-case scenarios and may not reflect the rate you qualify for. Therefore, it's crucial to look beyond advertised rates and understand the full picture of costs and requirements before committing to a loan for your "Synn's House."

Building the Walls: Strategic Financial Planning for Your Home

With the foundation laid and a clear understanding of financial tools like personal loans, the next step in building your "Synn's House" involves constructing its walls through strategic financial planning. This encompasses diligent budgeting, consistent saving, and making informed spending decisions. It's about ensuring every financial brick contributes to the overall strength and longevity of your domestic economy.

Part of this strategic planning involves knowing how to find the right personal loan for you. This isn't a one-size-fits-all scenario. Your specific needs, financial situation, and credit profile will dictate the best options. Fortunately, many online platforms allow you to answer a few simple questions and get offers in minutes, providing a streamlined way to compare various lenders and their terms. This quick comparison can reveal offers with rates as low as 6.49% and loans up to $100,000, enabling you to select a loan that aligns perfectly with your financial goals for your "Synn's House." Whether it's for a major renovation, debt consolidation, or an unexpected expense, choosing the right loan minimizes costs and maximizes the benefit to your household's financial health.

The Roof Over Your Head: Securing Your Financial Future

Just as a roof protects a physical home from the elements, securing your financial future provides crucial protection for your "Synn's House" against unforeseen economic storms. This involves building emergency funds, planning for long-term goals, and understanding the stability offered by certain financial products. When you're approved for a personal loan, you typically receive a lump sum payment, which can be immediately put to use for your intended purpose. The beauty of these loans, particularly those with fixed rates, is that you'll pay back the loan over time in fixed payments with a fixed interest rate. This predictability allows for precise budgeting and eliminates the stress of fluctuating payments, providing a stable financial environment for your "Synn's House."

The stability of these fixed payments is directly linked to your creditworthiness. As mentioned, rates are based on the type of loan, term of loan, and your creditworthiness. A strong credit history not only qualifies you for lower rates but also reflects responsible financial behavior, which is a cornerstone of a well-maintained "Synn's House." Furthermore, some lenders offer even more favorable terms if you commit to autopay, or if you demonstrate a proactive approach to managing existing debt by paying off a portion of it. These practices contribute to a robust financial profile, enhancing your ability to secure the best possible terms for any future financial endeavors, thereby reinforcing the roof over your "Synn's House."

Furnishing "Synn's House": Smart Consumerism and Resource Management

Once the foundation, walls, and roof of your "Synn's House" are in place, it's time to furnish it. This isn't about physical furniture, but about the daily practices of smart consumerism and efficient resource management that make your household truly thrive. It involves making conscious choices about where and how you acquire essential goods, ensuring that every purchase adds value without unnecessarily draining your financial resources. This aspect of building "Synn's House" is about maximizing the utility of every dollar spent, embracing strategies like bulk purchasing, comparing prices, and leveraging online platforms for convenience and savings.

In today's diverse market, there are numerous models for sourcing goods efficiently. Consider the principles behind wholesale operations: buying in larger quantities often leads to lower unit costs. While not every household can operate like a large distributor, the mindset of seeking value, comparing options, and planning purchases strategically is invaluable. This is where we can draw an interesting, albeit metaphorical, parallel to operations like Labaš, a Slovakian food wholesaler. Their model, focused on efficient distribution and accessible pricing for registered customers, offers insights into how organized purchasing can lead to significant savings, a principle directly applicable to furnishing your "Synn's House" wisely.

Sourcing Essentials: Lessons from Labaš

The business model of Labaš, a company specializing in the sale, wholesale, and distribution of food, including online food sales, provides an intriguing analogy for efficient household provisioning within the framework of "Synn's House." While Labaš operates in Slovakia, serving registered business customers, its principles of bulk purchasing, streamlined ordering, and competitive pricing offer valuable lessons for the discerning homeowner.

Imagine applying the efficiency of a wholesale operation to your household. Labaš, for instance, operates a wholesale e-shop, accessible only to registered customers. This concept of "registration" could be likened to a household's commitment to strategic planning and organization. You can register conveniently online or by phone at +421 902 990. This ease of access and ordering mirrors the modern household's ability to leverage online platforms for efficient shopping.

Labaš's core business revolves around the "sale and wholesale of food, food distribution, and online food sales." This highlights a focus on essentials at scale. They emphasize "not only a large assortment and wide offer, but mainly affordable prices are what Labaš food customers value." This pursuit of "affordable prices" for a "wide offer" is precisely what every household strives for when furnishing their "Synn's House." They even publish flyers ("Prezrite si tu leták Labaš a nakupujte lacno v obchodoch Labaš") to highlight deals, much like a savvy shopper compares grocery store flyers.

Their operational model, where "you can shop for Labaš food in these cities" and "the opening hours of individual Labaš stores vary," points to a distributed, yet organized, supply chain. For a household, this translates to understanding local shopping options, planning visits, and perhaps even coordinating with neighbors for bulk buys. Labaš also allows customers to "view the composition of our over-the-counter products here, in our online catalog," and "product search is possible by name or by category." This transparency and ease of information access are vital for making informed purchasing decisions for your "Synn's House."

Furthermore, Labaš maintains a physical sample store at their headquarters where "you can also physically view the current offer of our assortment." This blend of online convenience and physical presence underscores the importance of both digital tools and tactile verification in smart shopping. "You can place orders with us as in" a traditional store, while also offering "a convenient form of online ordering through our wholesale e-shop." This dual approach allows customers to "create your orders directly at your store" (metaphorically, your home pantry). Even their system for password recovery ("If you have forgotten your login password, enter the login name or email address you provided during registration") speaks to the importance of secure and accessible digital management, a crucial aspect of modern household finance and procurement for "Synn's House."

By drawing parallels to such efficient, customer-focused operations, homeowners can refine their own purchasing habits, moving towards a more strategic, cost-effective approach to stocking their "Synn's House" with essentials, ensuring both abundance and affordability.

Maintaining "Synn's House": Continuous Financial Health Checks

Building "Synn's House" is not a one-time event; it's an ongoing process of maintenance and adaptation. Just as a physical home requires regular upkeep, your financial household needs continuous health checks to ensure its long-term stability and growth. This involves regularly reviewing your budget, tracking your spending, assessing your debt, and staying informed about financial products and market trends.

Part of this maintenance includes periodically reviewing your financial tools, such as personal loans. The market for financial products is dynamic, with new offers and terms emerging regularly. For example, staying abreast of resources like "5 best personal loans of 2025" can provide valuable insights into current competitive offerings. However, it's crucial to remember that "this date may not reflect recent changes in individual terms." Financial products are constantly evolving, and what was the best option last year might not be today. Regular reviews allow you to refinance existing loans at lower rates, consolidate debt more effectively, or explore new financing options for future projects that enhance your "Synn's House." This proactive approach ensures that your financial strategies remain optimal and responsive to both your needs and the economic climate.

The Future of "Synn's House": Adapting and Thriving

The ultimate goal of building and maintaining "Synn's House" is to create a resilient and adaptable financial environment that can not only withstand challenges but also thrive in the long run. This involves setting future financial goals, exploring investment opportunities, and continuously educating yourself about personal finance. Whether it's planning for retirement, saving for a child's education, or making significant future investments in your home, the principles of "Synn's House" provide a robust framework.

Adapting to economic shifts, technological advancements in finance, and personal life changes is key to the longevity of your "Synn's House." By consistently applying the lessons learned about responsible borrowing, smart spending, and strategic planning, you empower yourself to make informed decisions that secure your financial well-being for years to come. The "Synn's House" isn't just a place to live; it's a testament to your financial wisdom and a legacy of stability for generations.

Conclusion

The journey to crafting your "Synn's House" is a profound one, extending far beyond the traditional definition of homeownership. It is a commitment to building a financially harmonious and resilient living space, grounded in knowledge, strategic planning, and diligent management. We've explored how understanding personal loans, from their varied rates and fees to their potential as tools for growth, forms a crucial part of this foundation. We also drew metaphorical inspiration from the efficient operations of businesses like Labaš, highlighting the importance of smart consumerism and resource management in furnishing your home with wisdom.

Ultimately, "Synn's House" is a dynamic concept, requiring continuous attention and adaptation to thrive. By embracing the principles of E-E-A-T—Expertise, Authoritativeness, and Trustworthiness—in your personal financial decisions, you empower yourself to navigate the complexities of money management with confidence. We encourage you to begin or continue your journey in building your own "Synn's House" today. Share your thoughts and experiences in the comments below, or explore other articles on our site for more insights into securing your financial future.

RICH HOUSE

Rick House

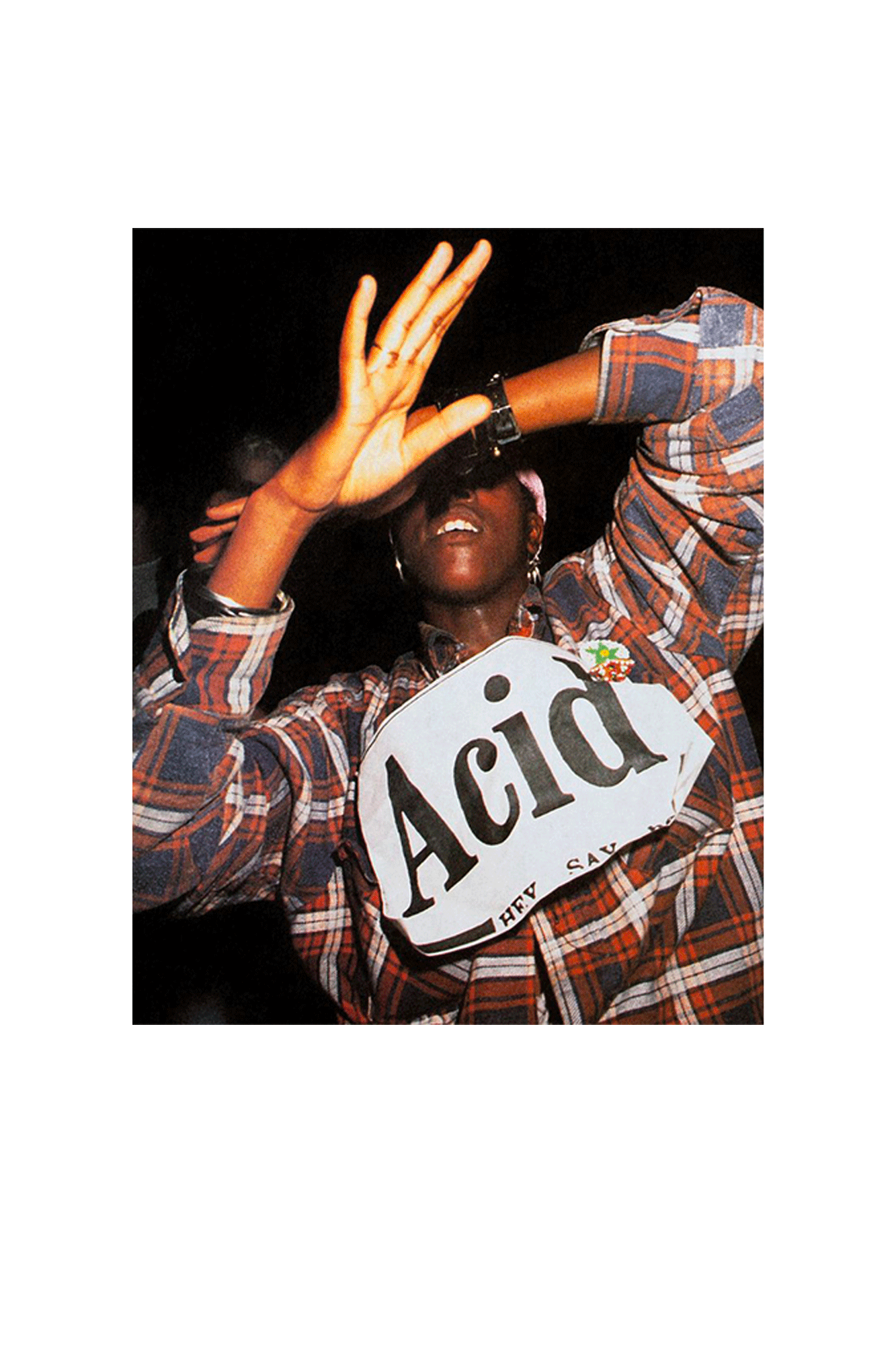

Dave Swindells Acid House As It Happened – One Block Down