Unveiling The Pelosi Tracker: Decoding Congressional Stock Trades

In an era where transparency and accountability are increasingly demanded from public officials, the rise of tools like the Pelosi Tracker has captured significant public attention. This innovative platform offers an unprecedented glimpse into the financial activities of one of America's most prominent political figures, Nancy Pelosi, specifically focusing on her stock market dealings. For many, it's not merely about curiosity but about understanding potential influences, ethical considerations, and the broader implications of politicians' financial decisions on public trust and policy. The insights provided by such trackers go beyond mere numbers, touching upon the very fabric of democratic governance and the integrity of public service.

The concept behind the Pelosi Tracker, and similar platforms that monitor congressional stock trades, stems from a fundamental desire for openness. It allows citizens to track Nancy Pelosi's stock trades, net worth, portfolio, corporate donors, proposed legislation, and more. This level of detail empowers the public to observe, analyze, and question the financial activities of their representatives, fostering a more informed and engaged electorate. As we delve deeper into what the Pelosi Tracker reveals, we uncover a fascinating intersection of politics, finance, and public scrutiny.

Table of Contents

- 1. What Exactly is the Pelosi Tracker?

- 2. Nancy Pelosi: A Brief Biography

- 3. Why Does the Pelosi Tracker Matter? The Quest for Transparency

- 4. Inside Nancy Pelosi's Investment Portfolio

- 5. Analyzing Pelosi's Stock Trades: Data and Insights

- 6. The Ethics and Legality of Congressional Stock Trading

- 7. Public Perception and the Impact of Transparency

- 8. The Future of Congressional Financial Oversight

- Conclusion: Empowering Informed Citizenship

1. What Exactly is the Pelosi Tracker?

The term "Pelosi Tracker" broadly refers to online platforms and initiatives designed to monitor and publicize the financial transactions, particularly stock trades, associated with former Speaker of the U.S. House of Representatives, Nancy Pelosi. While Nancy Pelosi herself is a congresswoman from California, the investment activity most frequently highlighted by these trackers is often attributed to her husband, Paul Pelosi, an investor who owns and operates Financial Leasing Services, Inc. These platforms meticulously analyze and display Nancy Pelosi's stock market activities, offering a clear view of her recent trades and investment strategies.

At its core, a Nancy Pelosi stock tracker is a comprehensive list of stocks invested by individuals closely associated with the former Speaker. It aims to provide real-time or near real-time updates on what Nancy Pelosi is trading, offering data for the latest stock trades, biggest positions held, average and total gains, and a complete history of all transactions. This includes not only direct stock purchases and sales but also insights into her overall portfolio, net worth, and even broader financial connections like corporate donors and proposed legislation that might intersect with her family's investments. The goal is to provide a transparent window into the financial dealings of a powerful political figure, allowing the public to connect the dots between policy, influence, and personal wealth.

2. Nancy Pelosi: A Brief Biography

Nancy Pelosi, born March 26, 1940, is an American politician who has left an indelible mark on U.S. political history. A Democrat representing San Francisco for nearly four decades, she is best known for her groundbreaking tenure as the 52nd Speaker of the United States House of Representatives. In 2007, she became the first woman to hold this powerful position, a testament to her political acumen and leadership. She served two non-consecutive terms as Speaker, from 2007 to 2011 and again from 2019 to 2023, making her one of the most influential figures in modern American politics.

Throughout her career, Pelosi has been a formidable force, known for her strategic legislative efforts and her ability to rally her party. Even at 84, she remains a powerful figure in U.S. politics, continuing to serve as a congresswoman from California. Her career is marked by significant legislative achievements, including her pivotal role in passing the Affordable Care Act. Her long and storied career, however, has also brought her financial dealings, particularly those of her investor husband, under intense public scrutiny, leading to the creation and widespread interest in the Pelosi Tracker.

2.1. Personal Data: Nancy Pelosi

| Attribute | Detail |

|---|---|

| Full Name | Nancy Patricia D'Alesandro Pelosi |

| Born | March 26, 1940 (age 84) |

| Birthplace | Baltimore, Maryland, U.S. |

| Political Party | Democratic |

| Spouse | Paul Pelosi (m. 1963) |

| Children | 5 |

| Alma Mater | Trinity College (B.A.) |

| Political Role | U.S. Representative for California's 11th congressional district (1987–1993), 8th (1993–2013), 12th (2013–2023), 11th (2023–present); Speaker of the House (2007–2011, 2019–2023); House Minority Leader (2003–2007, 2011–2019) |

| Net Worth Estimate | Varies widely, often cited in tens or hundreds of millions (including family assets) |

3. Why Does the Pelosi Tracker Matter? The Quest for Transparency

The significance of the Pelosi Tracker extends far beyond mere public curiosity about a politician's wealth. It taps into fundamental questions of transparency, accountability, and the potential for conflicts of interest within the highest echelons of government. In a democratic society, citizens expect their elected officials to act in the public's best interest, free from personal financial gain influenced by their legislative power or access to privileged information. This is where the YMYL (Your Money or Your Life) principles become particularly relevant, as the public's financial well-being can be directly impacted by legislative decisions.

The ability to track Nancy Pelosi's stock portfolio, investments, and trading activity provides a critical mechanism for oversight. When politicians or their immediate family members engage in active stock trading, especially in sectors that are directly affected by legislation or government contracts, it raises legitimate concerns. For instance, if a politician invests heavily in a technology company just before legislation beneficial to that company is passed, or if they sell shares in a sector anticipating adverse regulatory changes, it can create an appearance of impropriety, even if no laws are technically broken. Estimates suggest Pelosi’s portfolio has already accumulated an impressive $9 million in profits, according to Quiver Quantitative, an insider and U.S. politician stock tracker, fueling public discussion and debate.

The Pelosi Tracker, therefore, serves as a vital tool for:

- Promoting Transparency: Shining a light on financial dealings that might otherwise remain opaque.

- Ensuring Accountability: Allowing the public and media to hold politicians accountable for their financial decisions.

- Identifying Potential Conflicts of Interest: Highlighting instances where personal financial interests might align with or diverge from public policy.

- Fostering Public Trust: By providing data, it helps build or erode trust, depending on what the data reveals and how it is perceived.

- Informing Public Discourse: Contributing to a more informed discussion about ethics in government and the need for stricter regulations on congressional stock trading.

4. Inside Nancy Pelosi's Investment Portfolio

Delving into the specifics of Nancy Pelosi's investment portfolio, as revealed by various trackers, offers a fascinating look at the types of assets and sectors her family has invested in. While the portfolio is technically managed by her husband, Paul Pelosi, its association with the former Speaker means it is scrutinized as part of her overall financial footprint. Let’s explore what’s inside Nancy Pelosi’s portfolio, which often includes significant positions in major technology companies, a sector frequently at the forefront of legislative debate and economic growth.

The Nancy Pelosi stock tracker trades show you data for the latest stock trades by Nancy Pelosi, biggest positions held by Nancy Pelosi, average and total gains, and a history of all the trades. This detailed view allows for an understanding of the investment philosophy and the scale of the financial activities. The portfolio often includes well-known names from the tech industry, which has historically shown strong growth, leading to substantial gains. This focus on high-growth sectors, coupled with the timing of some trades, has frequently been a point of public discussion and media interest.

4.1. Key Holdings and Investment Patterns

The publicly available data from trackers often highlights several key characteristics of the Pelosi portfolio:

- Technology Focus: A recurring theme in the portfolio is a significant allocation to major technology companies. These are often household names that are subject to intense regulatory scrutiny and legislative discussions in Congress.

- Strategic Timing: Critics and observers often point to the timing of certain trades, which sometimes precede significant market movements or legislative developments. This perceived foresight is a primary driver of interest in the Pelosi Tracker.

- Diversification (within limits): While tech often dominates, the portfolio does show some diversification across other sectors, although the most notable gains are frequently attributed to tech investments.

- Long-term and Short-term Plays: The tracker reveals a mix of both long-term holdings and more active, short-term trading, indicating a dynamic investment strategy.

It's important to note that the information available typically pertains to stock trades and investments. While the "Data Kalimat" mentions "corporate donors" and "proposed legislation," the direct financial data provided by most stock trackers focuses on the investment portfolio itself, with any links to donors or legislation being inferences or analyses made by external parties rather than direct data points within the stock tracker's core function. The public's interest remains high because of the sheer volume and perceived success of these trades, leading to questions about the information advantage that politicians might possess.

5. Analyzing Pelosi's Stock Trades: Data and Insights

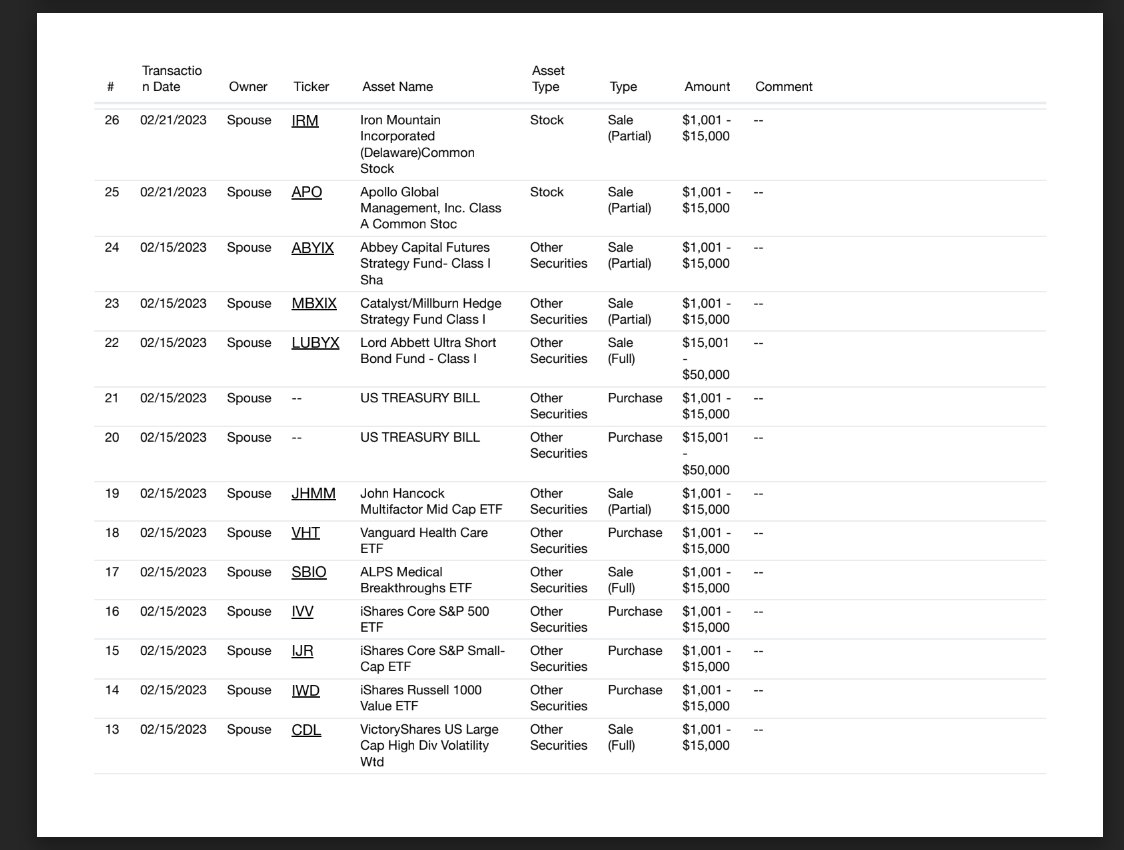

The raw data provided by a Nancy Pelosi stock tracker is a goldmine for anyone interested in financial transparency and political ethics. These trackers don't just list stocks; they provide a granular view of the trading activity. Below is the list of the most current stock trades of Congresswoman Nancy Pelosi, former House Speaker, showing the specific dates, companies, types of transactions (buy/sell), and estimated values. This level of detail allows for a deeper analysis of trends, patterns, and the potential implications of these financial moves.

Analyzing the trades involves looking at several key metrics:

- Latest Stock Trades: What were the most recent purchases or sales? The recency of a trade often garners the most attention, especially if it involves a company in the news or a sector facing legislative changes.

- Biggest Positions Held: Which companies represent the largest portion of the portfolio? These are the investments where the most capital is concentrated, indicating significant conviction or long-term strategy.

- Average and Total Gains: Estimates from sources like Quiver Quantitative frequently highlight the impressive profits accumulated. These figures provide a quantitative measure of the portfolio's performance, often leading to the phrase, "Just updates about our queen who never loses."

- History of All Trades: A comprehensive history allows for trend analysis, revealing if certain sectors are consistently favored or if there's a pattern of buying before positive news and selling before negative news.

5.1. The Mechanics of Tracking Congressional Trades

So, how do these trackers work? The foundation of any Pelosi Tracker lies in publicly available financial disclosure forms. Under federal law, members of Congress are required to disclose their financial transactions, including stock trades, within a certain timeframe (typically 45 days after the transaction). These disclosures are submitted to the House or Senate clerk and become public records.

Dedicated platforms and financial data firms then aggregate and process this raw data. They often use sophisticated algorithms and data visualization tools to:

- Scrape Data: Automatically collect information from official government disclosure websites.

- Standardize and Cleanse: Organize the data into a consistent format, correcting any inconsistencies.

- Analyze and Interpret: Calculate gains/losses, identify key positions, and flag unusual trading patterns.

- Present User-Friendly Interfaces: Display the complex financial data in an easily digestible format, often with charts, graphs, and search functionalities.

6. The Ethics and Legality of Congressional Stock Trading

The existence and popularity of the Pelosi Tracker inherently raise critical questions about the ethics and legality of congressional stock trading. While it is generally legal for members of Congress and their spouses to buy and sell stocks, the unique position they hold – with access to sensitive information and the power to influence markets through legislation – creates a fertile ground for ethical dilemmas and the perception of insider trading. This is a crucial area for YMYL considerations, as it directly impacts public trust in financial markets and government integrity.

The primary concern revolves around the potential for members of Congress to use non-public information gained through their official duties to make profitable trades. This is often referred to as "political insider trading." Even if direct, provable insider trading is rare, the appearance of it can severely erode public confidence. The data from a Nancy Pelosi stock tracker, for instance, might show trades that, in hindsight, appear incredibly well-timed, leading to public speculation and calls for stricter regulations.

6.1. Navigating the STOCK Act

In response to growing concerns about potential insider trading by members of Congress, the Stop Trading on Congressional Knowledge (STOCK) Act was signed into law in 2012. This bipartisan bill aimed to increase transparency and prevent members of Congress, their families, and their staff from using non-public information for personal financial gain. Key provisions of the STOCK Act include:

- Mandatory Disclosure: Requiring members of Congress to publicly disclose stock transactions exceeding $1,000 within 45 days of the trade. This is the data that fuels the Pelosi Tracker.

- Prohibition on Insider Trading: Explicitly stating that members of Congress are not exempt from insider trading laws.

- Public Accessibility: Mandating that these financial disclosures be made available online in a searchable, sortable, and downloadable format.

7. Public Perception and the Impact of Transparency

The public's perception of politicians' financial dealings is a crucial element in maintaining trust in democratic institutions. The insights provided by a Nancy Pelosi stock tracker have a direct impact on this perception. When a politician's portfolio shows consistent, significant gains, especially in volatile markets or during periods of legislative activity related to their investments, it can lead to cynicism and a belief that the system is rigged. This sentiment is often encapsulated in phrases like, "Just updates about our queen who never loses," which, while perhaps meant as a jest, underscores a deeper public unease.

The media plays a significant role in shaping this perception, often highlighting the most successful or controversial trades. This focus, while important for accountability, can also simplify complex financial situations and sometimes fuel narratives of unfair advantage. However, the underlying demand for transparency is undeniable. The public wants to know that their representatives are working for them, not for their own financial enrichment. The existence of tools like the Pelosi Tracker empowers citizens to form their own opinions based on disclosed data, rather than relying solely on political rhetoric.

Conversely, increased transparency can also help to dispel unfounded rumors and demonstrate that many politicians adhere to ethical standards. By making financial data readily available, it allows for a more informed public debate, moving beyond mere speculation to data-driven analysis. Ultimately, the impact of such trackers is twofold: they serve as a watchdog, but also as a potential bridge to greater public understanding and trust, provided the data is interpreted responsibly and contextually.

8. The Future of Congressional Financial Oversight

The continuous scrutiny brought about by tools like the Pelosi Tracker suggests that the future of congressional financial oversight is likely to become even more rigorous. There is a growing bipartisan push for reforms that go beyond the current STOCK Act, aiming to completely eliminate the potential for conflicts of interest or the appearance thereof. These proposed reforms often include:

- Banning Individual Stock Trading: A complete prohibition on members of Congress and their immediate families from owning or trading individual stocks. Instead, they would be required to invest in diversified mutual funds or exchange-traded funds (ETFs) or place their assets in a qualified blind trust.

- Stricter Disclosure Timelines: Shortening the 45-day disclosure window significantly, perhaps to a few days, to provide more real-time transparency.

- Enhanced Enforcement: Increasing the penalties for non-compliance with disclosure requirements and strengthening the enforcement mechanisms.

- Expanded Scope: Broadening the types of financial assets that must be disclosed, potentially including cryptocurrency holdings or complex derivatives.

The ongoing public debate, fueled by the data from trackers like the Nancy Pelosi stock tracker, highlights a societal shift towards demanding higher ethical standards from elected officials. As technology advances and data becomes even more accessible, the ability to monitor and analyze politicians' financial activities will only become more sophisticated. This trend signifies a collective desire for a government that is not only effective but also unimpeachably ethical in its financial dealings, ensuring that public service remains truly about serving the public.

Conclusion: Empowering Informed Citizenship

The "Pelosi Tracker" is more than just a list of stock trades; it represents a powerful movement towards greater transparency and accountability in government. By meticulously analyzing and displaying Nancy Pelosi's stock market activities, along with those of other politicians, these platforms offer a clear view of investment strategies and potential conflicts of interest. The data, whether it's the latest stock trades, biggest positions held, or accumulated profits, fuels public discourse and empowers citizens to hold their representatives to a higher ethical standard.

In an increasingly complex financial and political landscape, tools like the Pelosi Tracker are indispensable. They embody the principle that the public has a right to know how their leaders manage their personal finances, especially when those finances intersect with their legislative duties. As we move forward, the demand for such transparency will only grow, pushing for stronger regulations and fostering a more informed and engaged citizenry. We encourage you to explore these trackers, delve into the data, and engage in the vital conversation about ethics in public service. What are your thoughts on congressional stock trading? Share your comments below, and consider exploring other articles on our site about financial transparency and government oversight.

- Nastya Williams

- How Tall Is Post Malone

- Stefanie Salvatore

- Therealrebeccaj Sextape

- 6movies Streaming

Nancy Pelosi Stock Tracker ♟ on Twitter: "Source:"

Nancy Pelosi Stock Tracker ♟ on Twitter: "Source:"

Nancy Pelosi Stock Tracker ♟ on Twitter: "Source:"